-40%

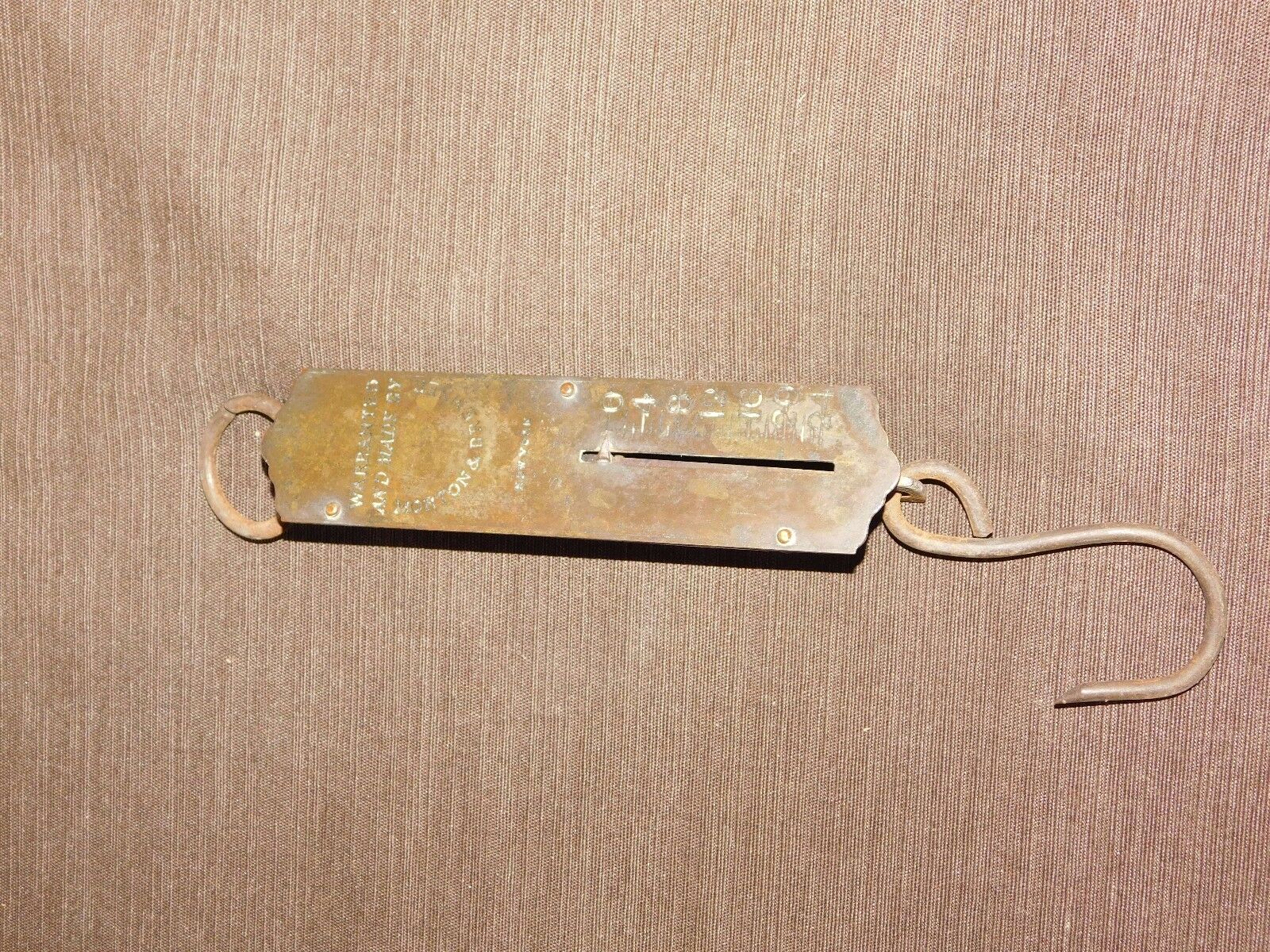

1913 Antique Scale Laclede Manufacturing Co of St. Louis Missouri Bronze brass

$ 123.24

- Description

- Size Guide

Description

CONDITION: VG Whenever possible we handpick our items for very good condition & quality; we also carefully examine each item we receive to ensure that each one meets our strict quality criteria. An extraordinary amount of care is taken for shipping and handling of the books and we provide a Free Tracking Number with all of our orders. Our items ship well packaged, protected with bubble wrap. We promise quick shipping and delivery. We strive to provide excellent service!ABOUT: Date: 1913 (based on inscription on bottom)

Medium: Bronze or brass Metal

Dimensions: 10 x 7 inches

Special Feature: Antique Scale Laclede Manufacturing Co of St. Louis Missouri

Laclede Mfg Co history:

Company History:

A leading scrap steel manufacturer, Laclede Steel Company manufactures carbon and alloy steel products, including pipe and tubular products, wire products, and welded chain. During the mid-1990s, Laclede's facilities included a steel-making plant in Alton, Illinois, a pipe finishing plant in Vandalia, Illinois, a chain manufacturing plant in Maryville, Missouri, a wire mill in Memphis, Tennessee, a wire oil tempering facility in Fremont, Indiana, and an electric resistance weld tubing mill in Benwood, West Virginia.

Organized in 1911, Laclede spent its formative decades recording only modest growth, at least compared to the pace of growth achieved by the company in its later years. For a scrap steel company, prosaic growth during the first half of the 20th century was common; Laclede was not alone in beginning its rise slowly within the steel industry. Though the steel industry as a whole represented one of the chief industries in the United States during the first half of the 20th century, its magnitude reflected the strength and enormous revenue volumes of the nation's primary steel manufacturers, the massive conglomerate corporations that dwarfed scrap steel companies like Laclede. It was not until roughly three decades after Laclede's formation that the demand for steel in the United States reached sufficient levels to transform scrap companies from anonymity to prominence, a phenomenon that provided the necessary impetus to at last propel Laclede's growth at a robust pace. Once through this period of maturation, Laclede blossomed, sharing in the explosive years of steel consumption following the Second World War.

Beginning with its first public sale of stock in 1911, an initial public offering that raised 0,000, Laclede embarked on the slow trek toward the prominence it would later achieve, operating as a small scrap metal manufacturer in Missouri. By turning scrap steel into finished products, the company established itself during its inaugural year as a regional manufacturing concern, small in size and scope yet resilient enough to withstand the pernicious pressures every fledgling business venture faces. The conclusion of the company's second year of business brought investors their first dividend payment, marking the beginning of one of the best dividend records in the steel industry. From 1912, through the economically cataclysmic 1930s and into the 1960s, Laclede maintained sufficient profitability to pay dividends to its investors each year, demonstrating a consistency within the notoriously cyclical steel industry that firmly established the company as a solid competitor. Annual sales, however, were held in check by the subsidiary position occupied by scrap steel manufacturers within the steel industry.

From Laclede's founding year in 1911 to the outbreak of the Second World War, annual sales rose only modestly, falling short of million by the time the company concluded its thirtieth year of business. The less-than-prolific growth of the company's annual sales would not have been worthy of note without the resolute rise in sales recorded after the conclusion of the Second World War, the two periods dividing Laclede's development into two chapters: one being the steady but slow growth of the company during its first 30 years of business and the second comprising a 15-year period of contrastingly different, energetic sales growth. (From their website)